When you hear the name Johnny Rogers, you may imagine some superhero’s alter-ego, and while the man himself doesn’t shoot lasers or read minds, he is suiting up this year to help the Corvallis community with their taxes.

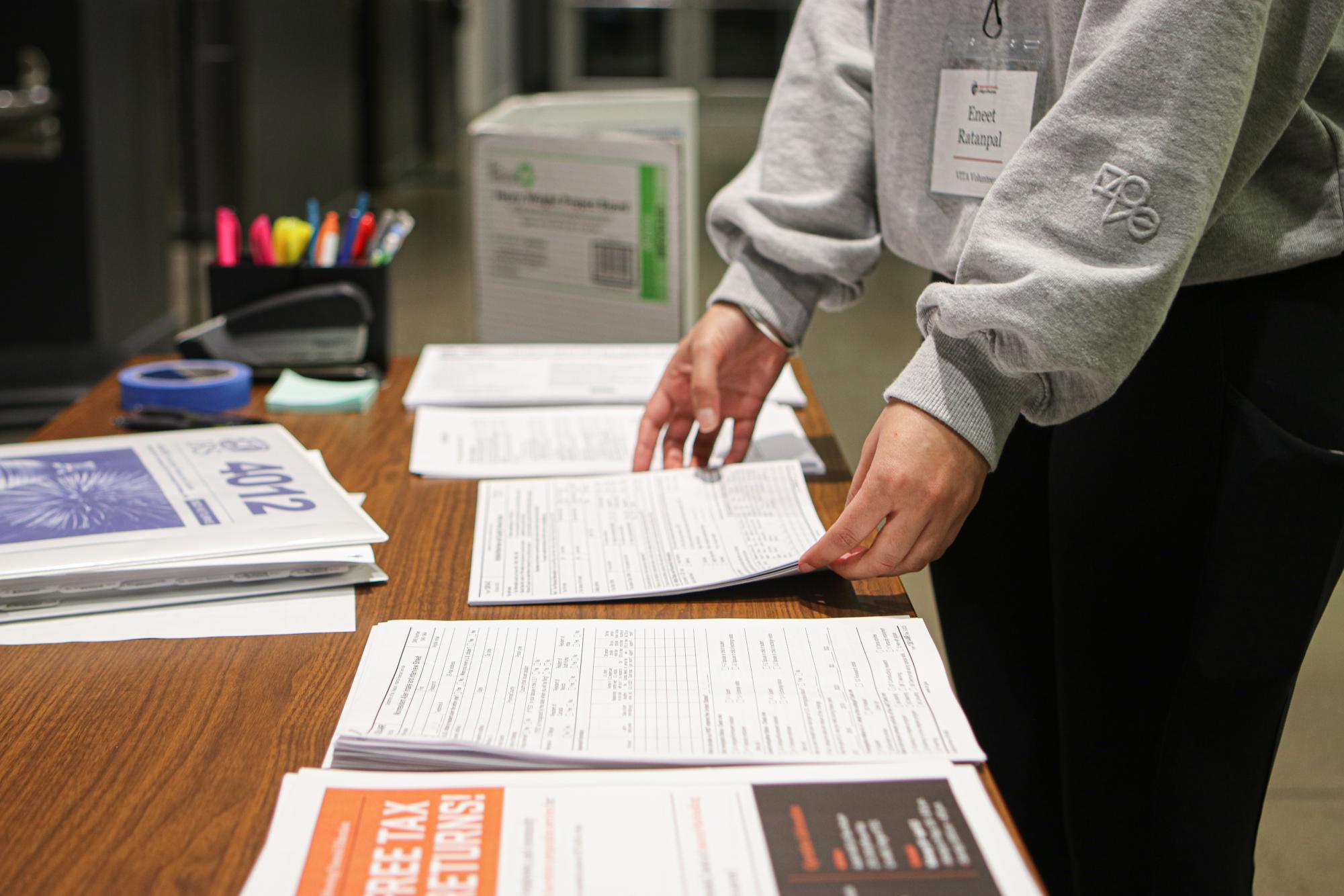

Rodgers is the program manager of the Volunteer Income Tax Assistance program, a program that runs from Feb. 19 to April 15, and helps Corvallis community members file their taxes.

“(We are) dedicated to helping the community in four ways.” Rogers said. “One, we help folks with lower moderate income. Two, we help folks who have a disability. Three, we help elderly folks. And then four, we help folks who speak English as a second language”

The VITA program is one of many Internal Revenue Service sponsored groups in Oregon and it is run by students in the Oregon State University College of Business, although Rogers said you don’t have to be a business major to volunteer.

All student volunteers are required to go through tax law training that meets IRS standards to make sure that they can effectively help the Corvallis community.

Rogers explained that the program leaders at VITA are taking inspiration from another program, MFS CASH Oregon.

“This year at OSU we are taking inspiration from (MFS CASH Oregon) and we’re looking to take our volunteer student organization and grow it here in Corvallis, as well as take it across Oregon, one of those channels being through OSU’s extension program,” Rogers said.

Fourth-year accounting major and VITA student volunteer Emily Plant explains that doing the VITA program has greatly expanded her understanding of the United States tax system.

“Now I know enough to do my taxes and I helped my sister do her taxes for the first time,” Plant said.

Not only does the VITA program teach students about business and taxes, but volunteers say it’s a great way to connect with the Corvallis community.

“You shouldn’t do it just because you want it on your resume. You should do it because you’re passionate about helping people, and helping the community, our primary goal.” Plant said.

Rogers said that many people in the community, especially those who have never filed their taxes before, aren’t aware of the credit that they may apply for.

“Oregon has the lowest uptake rate of the child tax credit in the country, maybe second to Nevada,” Rogers said.

This means that many people in the Corvallis community aren’t claiming their children as dependents, which leads them to missing out on tax credits that they are owed.

Another resource that is available to students is the OSU Center for Advancing Financial Education which provides financial counseling for students as they navigate their finances on their own for the first time.

The VITA program aims to educate people on the tax credit that they are owed as well as make the tax filing process seem less daunting.

“I get it,” Plant said. “The way the tax system is set up in the U. S., you don’t know what you owe until you file your taxes, which can be really scary.”

In order to take advantage of the VITA program, one only needs to book an appointment through the VITA website. Appointments are available from 5:30 p.m. to 8:30 p.m. throughout the tax season and all information on what to bring is also available on their website.

“I want (the Corvallis community) to know that we are here and accessible to them,” Rogers said.

![Newspaper clipping from February 25, 1970 in the Daily Barometer showing an article written by Bob Allen, past Barometer Editor. This article was written to spotlight both the student body’s lack of participation with student government at the time in conjunction with their class representatives response. [It’s important to note ASOSU was not structured identically to today’s standards, likely having a president on behalf of each class work together as one entity as opposed to one president representing all classes.]](https://dailybaro.orangemedianetwork.com/wp-content/uploads/2025/03/Screenshot-2025-03-12-1.00.42-PM-e1741811160853.png)