‘Entitlement’ often confused with fairness

December 2, 2015

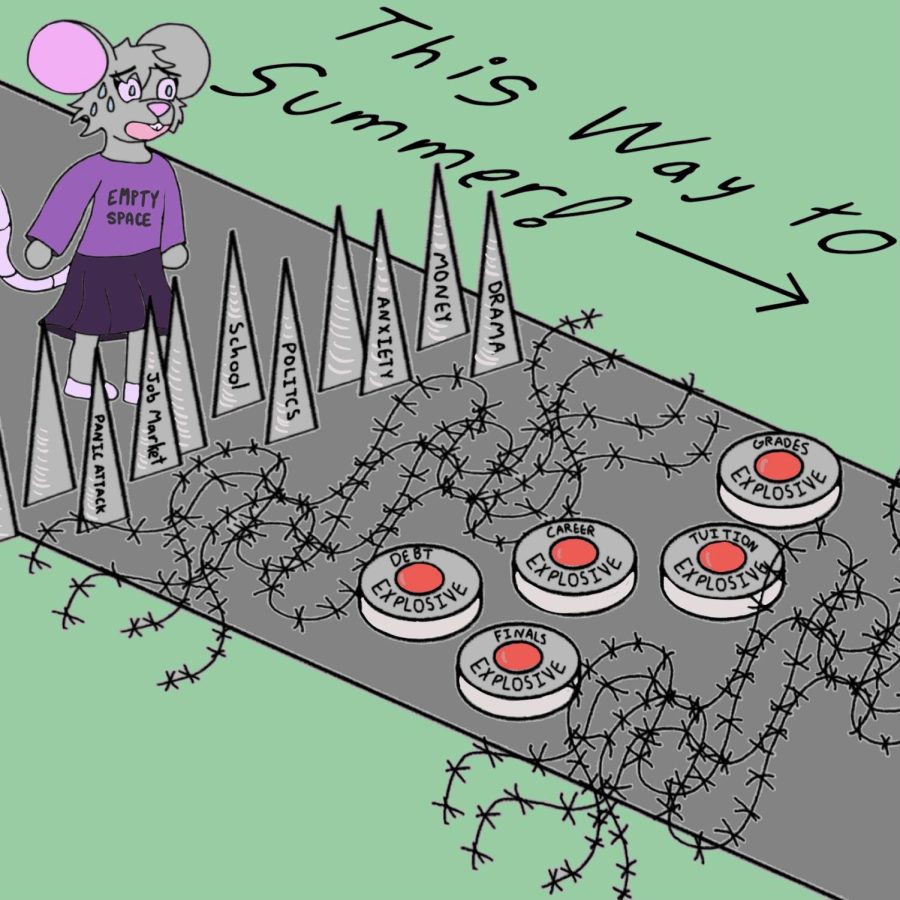

I’ve heard the general argument that millenials are the so-called “entitled” generation when compared to those in the past, because we ask for so much without actually working for it.

We’re “entitled” because we want to be compensated for more than 40 hours of work a week.

We’re “entitled,” because $20,000-100,000 in college loan debt to help pay for tuition costs (around $26,295 for Oregon State University non-resident students per year) is a problem.

This doesn’t really make much sense, considering our relatives before us paid less for college tuition prices and didn’t have to take a second job on the side of a summer occupation and living costs were much lower before modern inflation.

So how is wanting to be fairly compensated for your work classified as “entitled”?

Yes, it is true that more millenials are living at home than ever before. One article from Forbes contributor Alexandra Talty mentions how “Some experts believe that although the labor market is rebounding, other factors are making it harder for young people to live independently.”

Such factors she mentioned include debt (as listed above), stagnant wages in the workforce and costs of living.

Though market inflation continues to rise, worker wages remain at an all time low.

Another recent article from Forbes supports this claim, which outlines how workers at Walmart cost taxpayers around $6.2 billion in benefits because of resources they need to make up the difference. The assistance mentioned includes health benefits and food costs.

I’d like to examine the bigger picture for a moment, assuming that one would take advantage of the “just work during your summers and you can pay for all your college expenses” one might hear from an old-fashioned relative.

In the past, students paid less for college tuition than they currently pay now.

If they went by the calculations given for overall costs on the OSU website, a non-resident student attending here could expect to pay $78,885 a year to attend college.

That’s $315,540 for an undergraduate degree.

At the current minimum wage price of $9.25 an hour, most students who worked a summer job could expect to make around $1,480 a month, or $4,440 in the three-month summer period outside of school.

Mind you, that’s if they get scheduled for all these hours in a week.

In four summers, that’s a whopping total of $17,760, or about 18 percent of total attendance costs required if you’re a non-resident student here.

So you work hard, study hard and manage to pay for 18 percent of your overall college costs before financial aid.

And if you complain about this, you’re “entitled?”

Allow me to be one of (hopefully) many to correct this assumption: No, you’re not entitled.

In fact, I’d say you’re more ticked off at the fact that your inflated costs aren’t matching up to your working wages.

You should be ticked off at this, especially if you’re dedicating as much time as you are to any program of study here at OSU.