In May, the Center for Advancement of Financial Education, et. al, released a letter informing Oregon State University students on upcoming changes that affect their college education.

In 2022, the university announced their Financial Readiness and Success initiative with the goal of implementing more flexible payment plans for students. The initiative also includes mechanisms to increase financial literacy around college affordability.

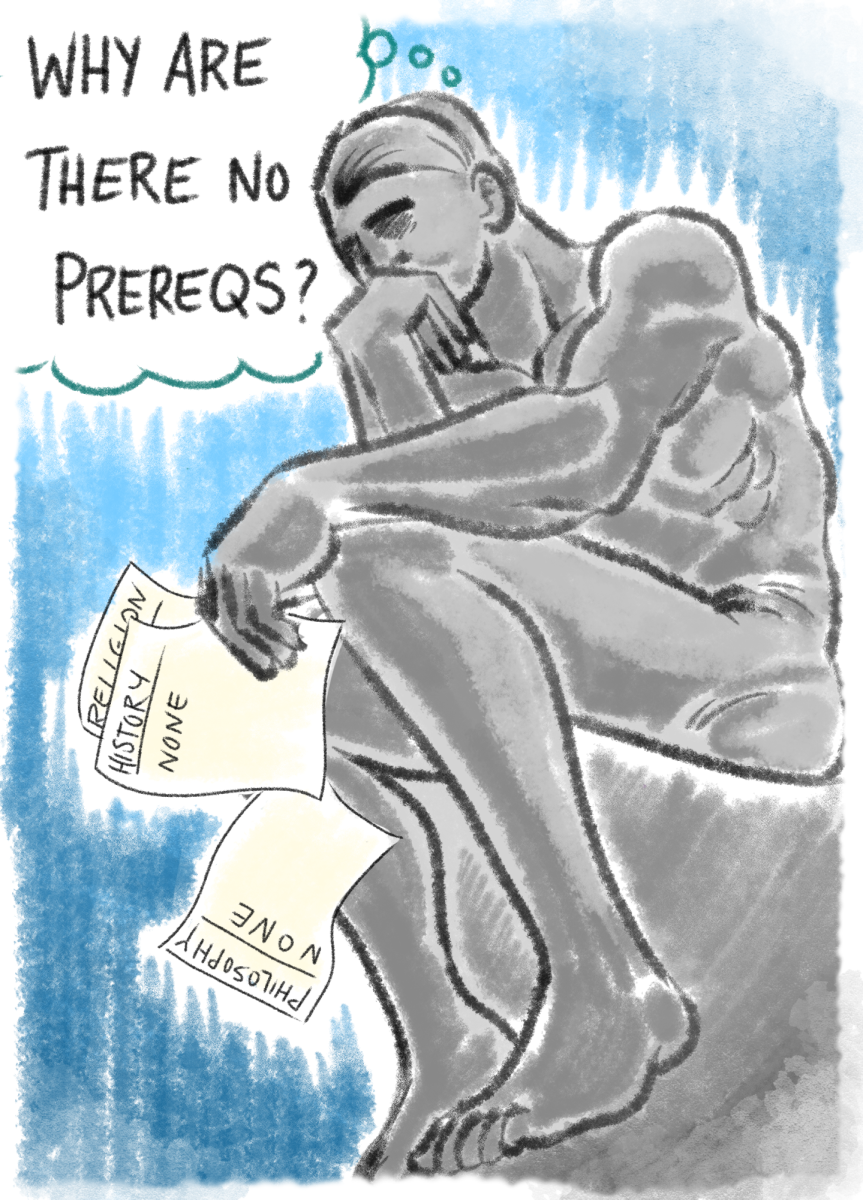

In their five-part approach, they plan to address financial well-being/literacy, account balance thresholds, enhancing payment plans, student registration and financial transcript holds.

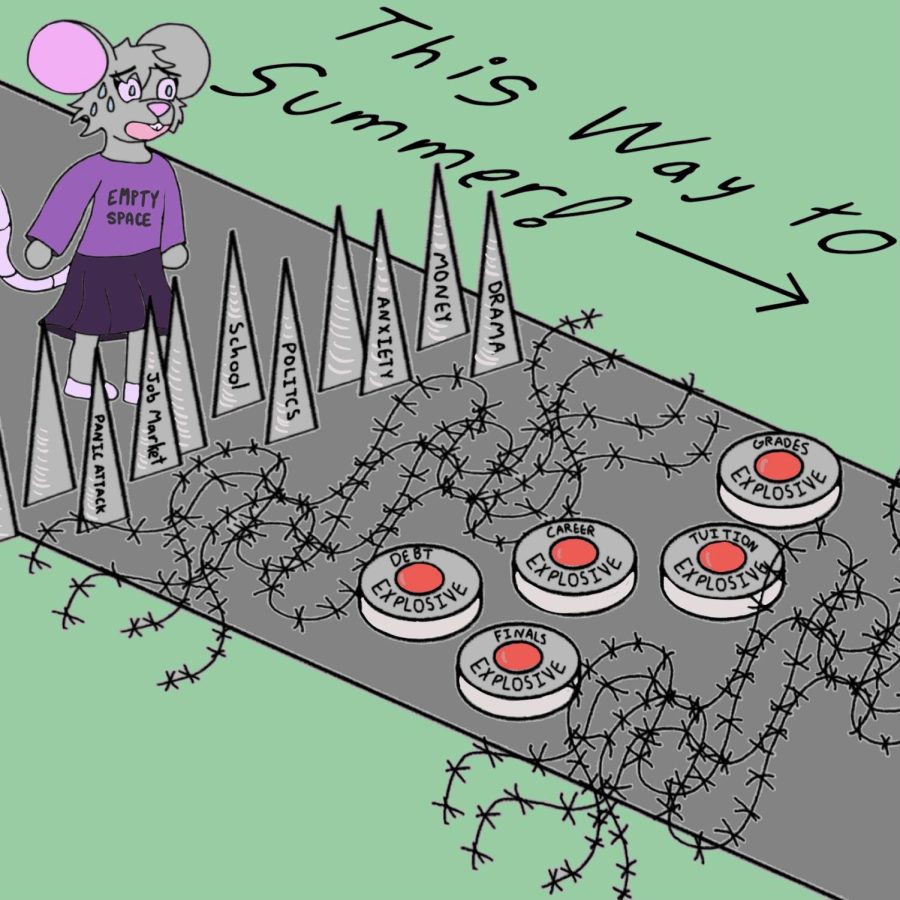

In addition, this plan also includes implementing a new account threshold for students wanting to register for classes. The balance allowed for students will decrease from $2,200 to $500, going into effect in November for 2024 winter term registration.

“This plan seems entirely unfair for current and prospective students that do not have a strong support system or are the only ones supporting their education,” said Leana Pavlenko, a Corvallis resident and ex-OSU student.

According to the OSU Office of the Registrar, with this plan they hope to increase retention and graduation rates of all students, and integrate and simplify technology systems, data practices and policies to increase organizational agility.

“This seems to be a pathway that only allows those that are extremely well off to enjoy higher education,” said Pavlenko.

In June 2023, the CAFE expanded their staff – adding more peer mentors – and services to discuss financial cost, budgeting, accessing resources and more with students. Beginning in Fall 2023, students will have access to an online financial literacy education program.

New payment plans will also be available for students for fall term. They will have more time to pay their bills and receive assistance before the next term.

The letter prepares students for phase one in their initiative, covering financial well-being/literacy, account balance thresholds and enhancing payment plans. Phase two will cover student registration and financial transcript holds, according to the Office of the Registrar.

The university claimed taking advantage of the coming resources will support financial wellness and decrease the amount of graduation debt.

“If that is their reasoning they should overall just lower tuition,” Pavlenko said.

Associate Vice Provost Rebecca Mathern responded in an email, saying, “We understand this may impact some students and OSU is working on mitigation strategies that could support those students that are in financial need.”

According to her, reducing the tuition at OSU is a priority, including seeking additional state funding for Oregon Opportunity grants, increasing institutional financial aid to more than $90 million next year and raising philanthropy for scholarships and financial assistance.

“Once (mitigation strategies) are finalized, we intend to follow up with each student that may be impacted by this one-time account threshold change,” Mathern wrote.