Student loan interest, repayment delayed until May 1; OSU Center for Advancing Financial Education can ‘increase financial literacy’

Keith Raab, director of financial aid at OSU, stands in front of the Kerr administration building on Jan. 26. Student loan repayments will remain paused at least until May 31 but Raab recommends students try to minimize the amount of student loans they take out.

February 10, 2022

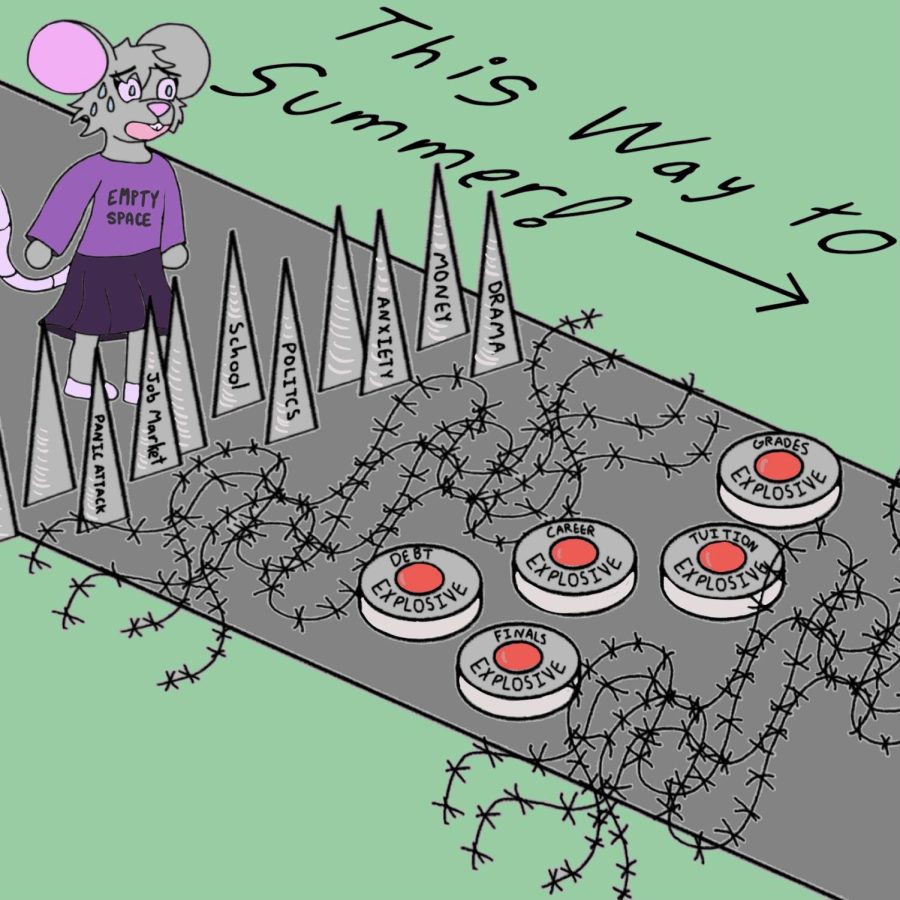

Student loan interest and repayment has been paused on federal loans since the beginning of the national state of emergency on March 13, 2020; the pause has been extended until May 1st.

Keith Raab, the director of Financial Aid at Oregon State University, said federal student loan payments and accumulation of interest were paused early in the pandemic to support individuals who lost their jobs and to take some pressure off students and alumni.

According to a press release from President Joe Biden, the pause on federal student loan payments has been extended due to the ongoing pandemic. While more jobs are being added and unemployment continues to drop, the press release claims more time is needed for many to recover.

According to the Free Application for Federal Student Aid website, only subsidized and unsubsidized loans taken out by students are included in this freeze. This means that the Parent PLUS loan—a loan taken out by parents on behalf of students—and private loans such as Sallie Mae are not subject to the same policy.

“About half of OSU students take out loans, and the average loan debt for students when they graduate from OSU is about $27,000,” Raab said.

Right now, the effect on current students due to this pause is minimal since payments do not begin until after graduation. Instead, this pause largely affects alumni who are currently paying back loans, although it also affects students who took out subsidized federal loans since they are not currently accumulating interest.

This pause is also only in place for federal loans, meaning that throughout the pandemic, former students are still required to repay interest and payments for private loans, such as those received from a bank.

According to College Ave, students tend to take out private loans when their federal loans run out, meaning individuals with the highest debt burden may still be required to make payments on loans, which may also be accumulating interest.

“I’ll likely have around $20,000 to $30,000 in student loans; I intend to pay them back by getting a job as soon as possible and living frugally until they’re paid off,” said Max Kemling, a third-year mechanical engineering major at OSU.

Programs for helping students to receive loan forgiveness include the public service loan forgiveness program, which absolves a student of their loans if they make payments for 10 years while working in public service. According to Raab, the $0 payments during the pandemic can even still count for relief programs such as this.

“To be honest I haven’t thought much about how I am going to pay back my loans with the exception of working and chipping away at them little by little,” said Sarah Briggler, a third-year biology major. “Most working veterinarians, due to the large amount of student debt that most have, typically don’t finish paying off their loans until their 30s or even 40s.”

According to Raab, OSU’s College of Business offers resources for repaying loans and recommends students go to the Center for Advancing Financial Education.

“They have advisors and peer advisors to help students set up a budget, prepare for financial stuff and to increase financial literacy,” Raab said.

Raab also recommends students minimize the amount of loans they take out and to try to graduate quickly. The people worst affected by student loan debt, according to Raab, are those that do not graduate, and then still have to repay the loans.

“I would just say that student loans, if you have to take them, are a way for you to pay for the education that you need,” said Raab. “Take as little student loans as you can, try not to accumulate a lot of debt. Try to move through to graduation at a steady rate. The closer you can remain to four years in graduation, that’s the least expensive it can be… Get to know your academic advisor, spend a lot of time with them, make sure you take what you need and graduate as quickly as you can.”