VITA volunteers available to file tax returns

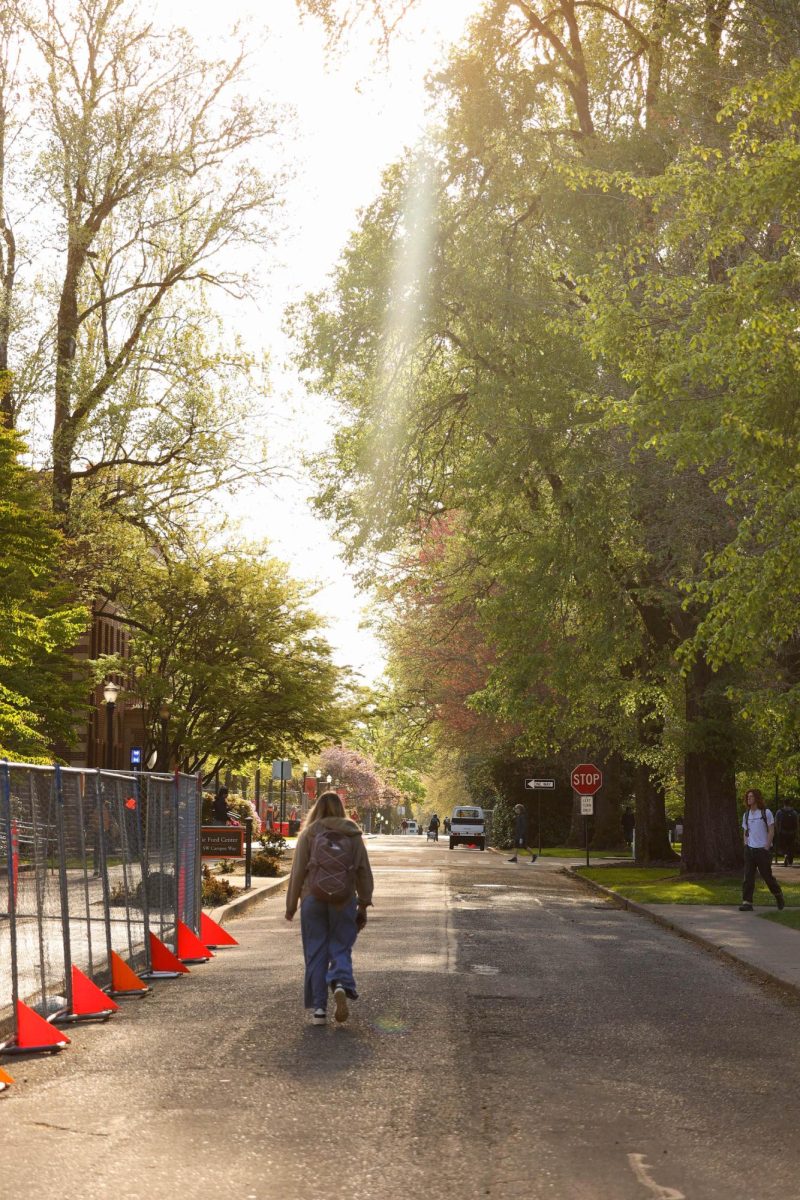

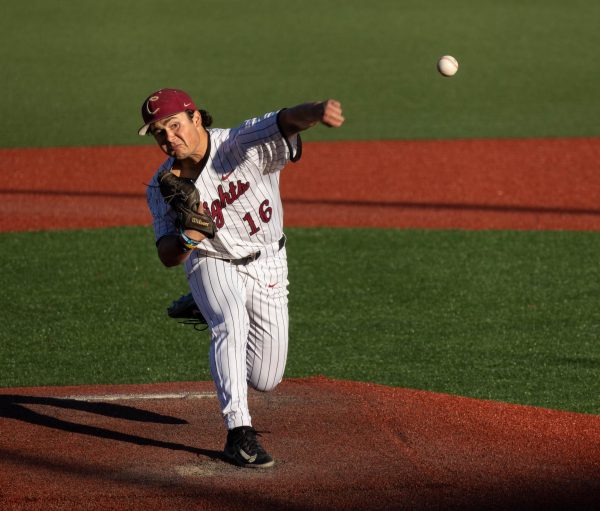

Pictured is Austin Hall, home to the College of Business at Oregon State University in Corvallis, Ore. On Tuesdays and Saturdays through April 18, VITA volunteers will be available to file tax returns for students and Corvallis community members in room 200 of Austin Hall. From the Orange Media Network Archives.

March 7, 2022

Student volunteers, alumni and community members at Oregon State University offer tax assistance through the Volunteer Income Tax Assistance program, which started Feb. 12 and lasts until April 18.

VITA, a nation-wide IRS program that offers free, simple tax return preparation, is made up of an array of volunteers from different majors, alumni and community members. At OSU, approximately 30 volunteers meet with people interested in VITA every Tuesday night and Saturday afternoon through April 18 in Austin Hall, room 200.

People who want their taxes prepared by VITA volunteers need to schedule an appointment and should bring the necessary tax documents, a driver’s license and a social security card for proof of identity for their appointment.

According to Brandon Holbrook, the VITA director at OSU, after an individual drops off the necessary documents, the tax returns will be ready in about one week.

Any Corvallis, Ore. community members or OSU students are able to receive assistance from VITA, as long as their income is less than $60,000. Holbrook said international community members, international students and students who are part of the Deferred Action for Childhood Arrivals program are also welcome to the VITA program so long as they meet the same income requirement.

VITA offers language services for English, Spanish, Chinese, Vietnamese and Korean, according to Holbrook. However, if a person needs assistance in a language not included, they must notify VITA while making their appointment so volunteers can plan for language assistance.

Holbrook communicates with the IRS to coordinate the training and exams for volunteers to be certified by the IRS for tax preparation.

Tax-preparation training happens every year as soon as December, when the IRS finishes the training guides and exams due to yearly tax-law changes. VITA volunteers learn basic tax laws and have access to a free tax software provided by the IRS to prepare simple taxes and taxes for individuals with low income.

“We’re a group of volunteers, we learned how to do taxes and we do free taxes for people who need help,” Holbrook said.

Rain Scarborough, a student in the design and innovation management major in the College of Business and member of VITA’s marketing team, is in their first year as a VITA volunteer. Initially, Scarborough said they felt VITA would not be “within [their] reach” because it dealt with taxes but decided to attend after the first meeting.

“The leadership made it sound really accessible because of all the training,” Scarborough said.

Kara Nagato, a second-year accounting student and returning VITA volunteer who will also be a site coordinator this year, said she is dealing with more administrative work than she did last year.

“I do like helping people, and doing taxes is not as difficult or hair-pulling as everyone makes it out to be,” Nagato said. “Since you don’t need to be a business student or an accounting student, I think it’s a good opportunity for anyone to learn about taxes.”

According to Holbrook, VITA is approaching its third year at OSU and volunteers aim to prepare at least 300 tax returns, 200 more than last year.

Despite COVID-19, volunteers are meeting with community members in person, but these individuals must fill out a form so volunteers can evaluate if they can do their taxes.

“From a COVID-19 perspective it’s very good,” Holbrook said. “We’re minimizing the amount of contact.”

According to Holbrook, VITA at OSU stands out to the IRS because it has the backing of OSU and the College of Business. VITA volunteers have been given a room for two months for meetings with students and community members, a computer lab and help from information technology professionals at the College of Business.

“These people every year who don’t think they need to file their taxes are missing out on the money,” Holbrook said. “It could be $1,000 or more.”