Tax season is here! Students gear up to file tax returns

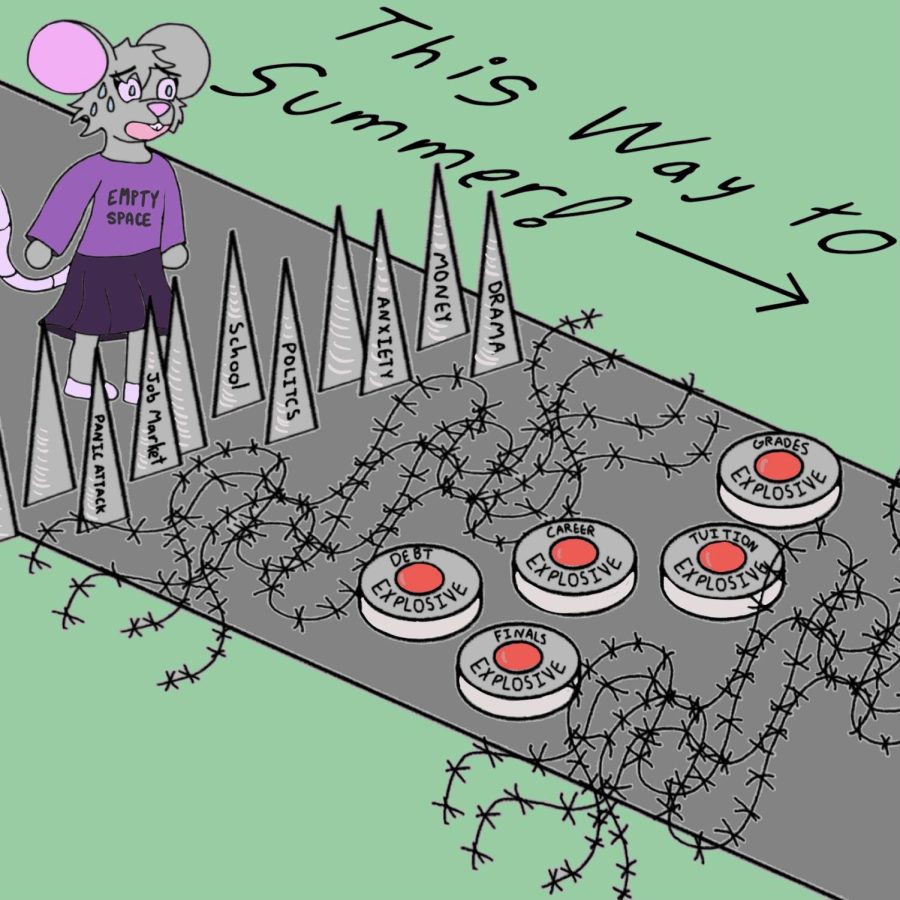

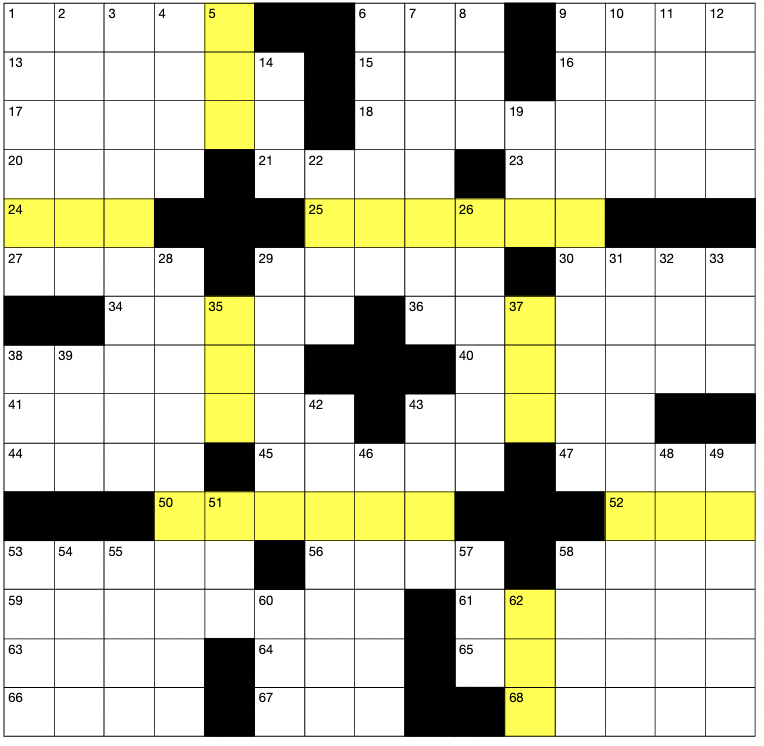

A photo illustration of a distressed student doing their taxes taken on Feb. 6. Tax season is coming up with a deadline of April 15.

February 27, 2023

It’s that time of year where most people are anxious—tax season! This year’s deadline for filing taxes is April 18, according to the Internal Revenue Service.

There are several sources through which students find out about filing taxes.

Bakhtiyar Doskenov, an international graduate student at Oregon State University in computer science, said he had training from the Office of International Services on how to use SprintTax, an online service that provides help filing tax returns.

However, Doskenov feels the training was insufficient and does not cover scenarios involving dependents such as children or a spouse.

International students’ dependents such as their spouse cannot work legally in the United States, however, are allowed to maintain a checking account and the interest that accrues on the account has to be reported as income to the IRS.

Tax filing can also get complicated for students especially if they have scholarships from the university alongside their income.

According to Doskenov, the scholarships he received from the college of engineering were before taxes, however, the income from his graduate assistantship was tax deducted, so he has to navigate them separately.

There are programs at federal and university level to help people with filing their tax returns—one of them is the Volunteer Income Tax Assistance program which is estimated to help around 140 people with their taxes this year.

Stephen McKay, who is the site coordinator for VITA at OSU, said the program provides free tax assistance to individuals and families with low to moderate incomes. OSU VITA is sponsored by the college of business and partners with the IRS, and their student and community volunteers receive training and certifications from the IRS.

According to OSU VITA’s website, anyone or any household including OSU students with income less than $60,000 are eligible to seek assistance.

This year, OSU VITA is partnering with multiple community organizations such as a refugee organization in Salem, an elderly community in Lebanon and a homeless shelter in Corvallis. However, international students are not eligible this year because the program does not have any volunteers certified to prepare international taxes.

Another challenge students typically face is how to file taxes when you have worked in multiple states in the same financial year. For example, last year, Doskenov worked as a graduate teaching assistant at OSU and also at a company in California in hybrid-mode.

He started working for the company in person but later switched to remote work and was working from Oregon. Doskenov is currently looking to contact OIS regarding this issue.

Andy Zhang, a graduate student in Electrical Engineering at OSU is currently working for an out-of-state company alongside pursuing his graduate school. Zhang only needs to file the state tax for Oregon as he is working remotely and one only needs to file taxes for the states in which they are physically working.

According to McKay, the OSU VITA program can assist individuals who need to file taxes in multiple states. However, the specific tax laws and requirements may vary between states, so it’s important to provide all the necessary documentation such as W-2 forms, 1099 forms and any other income or deduction records to ensure accurate filing.

In addition to this, both Doskenov and Zhang feel that it is important to not forget to report the earnings from stocks and cryptocurrency investments.

According to McKay, although tax requirements for undergraduates and graduate students are similar, undergraduate students are more likely to be able to claim the American Opportunity Tax Credit, which is a refundable tax credit up to $2,500.

On the other hand, graduate students are able to claim the Lifetime Learning Credit, which is not refundable. Both of these tax credits are to subsidize a student’s costs of attending college.

When offering advice to other students, Doskenov said, “do it as early as possible.” He also mentioned that if a student has dependents or is filing taxes jointly with their spouse, it is worth contacting a tax advisor at least once.

“If you’re not sure about how to file your taxes or have any questions, seek assistance from the VITA program or a qualified tax professional,” McKay said.

For more information, students are encouraged to contact OSU VITA program at [email protected] or look up https://beav.es/vita. Students can also check out IRS Free File to see if they are eligible to file federal income tax for free.