Rising rent costs seem to disproportionately impact OSU students

February 27, 2023

Rising rent costs are not a new phenomenon in Corvallis. When coupled with the housing shortage, Oregon State University students are facing a hard time finding a house, let alone its affordability.

26% of Corvallis’ population is “rent burdened,” the highest in the State of Oregon, according to the City of Corvallis Land Development Information Report in 2021. The Department of Housing and Urban Development defines rent burden as “households who pay more than 30% of their income for housing” and “may have difficulty affording necessities such as food, clothing, transportation and medical care.”

Corvallis also ranks as the city with the most “severely-rent burdened” population in the state of Oregon with 37% of the households paying more than 50% of their income on rent.

Max Klamath, a first-year master’s student in the Department of Women, Gender and Sexuality Studies at OSU said that around one-third of their income goes into paying rent.

Another graduate student, Miles Moran, who studies statistics at OSU, said that he used to pay about 80% of his income as rent in a previous one-bedroom apartment where he lived alone until this summer.

Klamath, who currently resides in Albany, expressed how difficult it was to find housing in Corvallis.

“I had been trying to move to Corvallis – just anywhere at all. And it is impossible. It is absolutely impossible,” Klamath said. “So I kind of just gave up after like six months of looking.”

Evan Park, a junior studying chemistry at OSU, said she moved out of a two-bedroom apartment because of housing costs. She paid a rent of $1,000 per month in the two-bedroom compared to $640 in her current five-bedroom house.

“The other place was really expensive and not really worth the price in my mind,” Park said.

An alternative source can be to look for on-campus housing. Park said that she did consider on-campus housing initially but on finding the rent to be expensive, she decided to drop the idea.

Moran said that he was not interested in housing for the same reason that none of the options available were affordable.

This trend of students looking for off-campus housing correlates with the data. Since 2016, the percentage of students who have enrolled themselves in on-campus housing has been consistent at about 19-20%, barring 2020 which saw a drop to around 10% due to COVID-19.

The time when one applies for housing is also crucial. Klamath, who received their admit from OSU in August, was unable to find housing in Corvallis since most students who come in fall start looking for housing around the months of June and July.

Noah Vaughan, a fifth-year Ph.D. studying physics also mentioned how when they first came to Corvallis, they struggled to find a place due to this discrepancy between leases and classes starting.

“I really struggled [but] I found a place where they could let me move in September,” Vaughan said.

Vaughan eventually found housing at the International House and was paying $800 per month as rent – almost half their income.

Moran also faced a similar difficulty finding housing at the end of this summer.

“If you didn’t respond to an advertisement, within 10 minutes, it was already gone,” Moran said. “Someone had already taken it.”

Klamath expressed concerns about the high barrier for housing applications where, in some cases the applicant was required to make two and a half to three times the rent to be even considered.

“I don’t know anyone who makes that much money. I don’t. I’ve never met a person who makes that much money,” Klamath said.

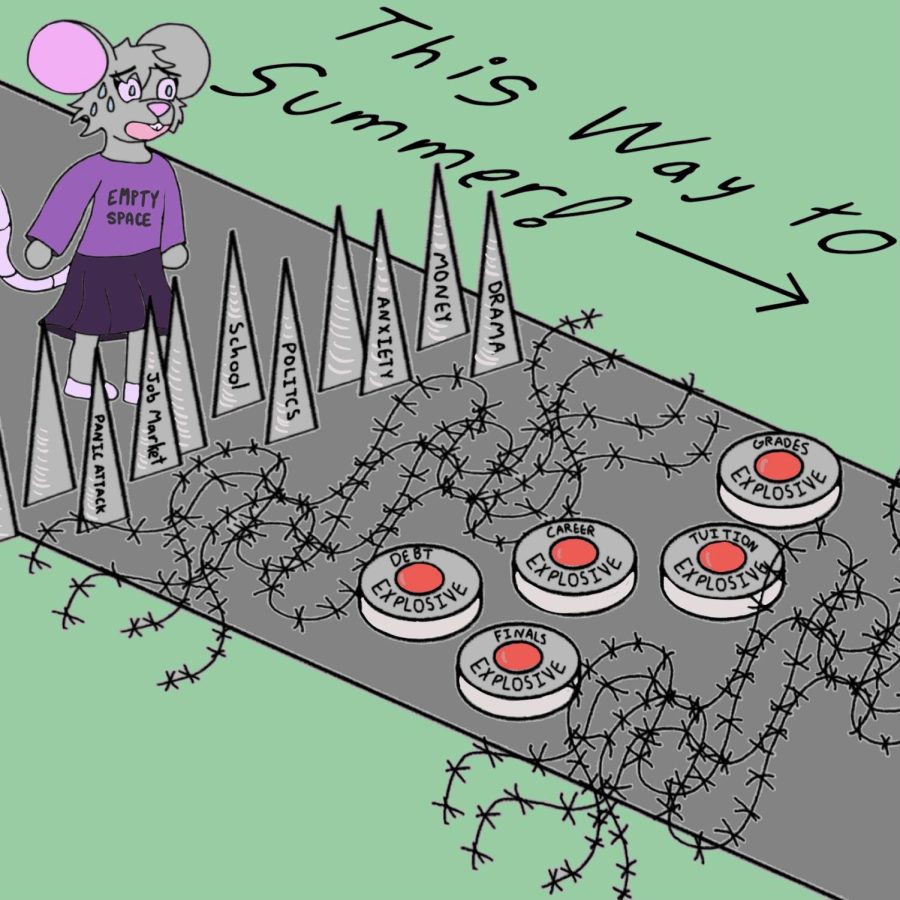

Students often find themselves in a situation where they have to make a choice between finding a house to live by themselves and pay significantly higher rent, or live in a shared housing and pay lower rent. Each of them have their pros and cons.

“I think it’s more fun, because I’m closer friends with these roommates,” said Park, who currently lives with four other roommates.

Vaughan, has been living in a housing cooperative with seven other people since March of this year.

In a cooperative housing, all people are equal owners of the house, meaning that each month they will pay an equal share towards the mortgage.There is no individual equity involved with the ownership of the co-op housing.

“Just working out: ‘How do we do governance? How do we do like sharing labor? How do we share costs?’” Vaughn said. “A lot of things are changing but we are very effectively trying to transfer some of the things we learned to this new place.”

Currently each resident pays about $150 per month as their share in Vaughan’s situation.

For Moran and Klamath, the situation has been different. Owing to personal preferences and accommodation of pets, they both have preferred single room housing.

“I prefer to live alone and I have two dogs. So sometimes, that’s not comfortable for people who already have pets or have cats or whatever,” Klamath said. “I just prefer to live by myself. It’s easier for me.”

Moran also explained how unstable employment during the summer in his department has impacted student’s academics.

According to Moran, students in his graduate program take their comprehensive exam at the end of summer – an exam that partially contributes to their master’s degree and his department expects the students to prepare for it during the summer – not considering other factors that may lead to instability in student’s life.

“Housing insecurity is not just a problem in and of itself, but now it’s causing this sort of interaction effect with other problems like (comprehensive) exams,” Moran said.

Paying a significant portion of salary towards rent also has effects on other aspects of students’ life. For example, Vaughan faced food insecurity during their first year at OSU when they were paying about half of their income as rent.

“Food was difficult, because a lot of times it’s like I was working late. And by the time I was done working, I couldn’t go grocery shopping, or eating out was too expensive a lot of times,” Vaughan said. “Food was definitely an issue.”

According to Vaughan, their situation has improved since they moved to the housing co-op.

For Klamath, these decisions between buying food and other expenses such as veterinary bills made rent costs even more of a concern.

“October was a really hard month and I probably paid like $1,600 in medical bills throughout October just just catching up to stuff that we owed,” Klamath said.

Vaughan and Klamath also emphasized that students, especially those who are new to Corvallis should know their rights as renters as they are gullible to be taken advantage of by landlords and property management companies.

“When people don’t know their rights, (renting) companies will charge higher deposits and then not get the deposit back,” Klamath said. “There’s a way that (landlords) can take advantage of people who don’t know what their rights are because they haven’t been renting very long.”