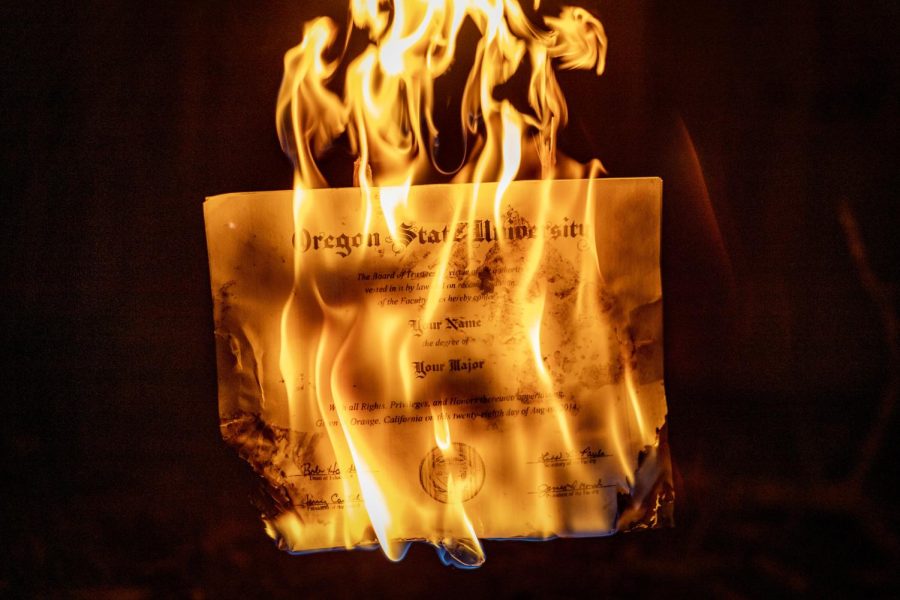

Firing Lane: College degrees, a valuable commodity or glorified paper weight?

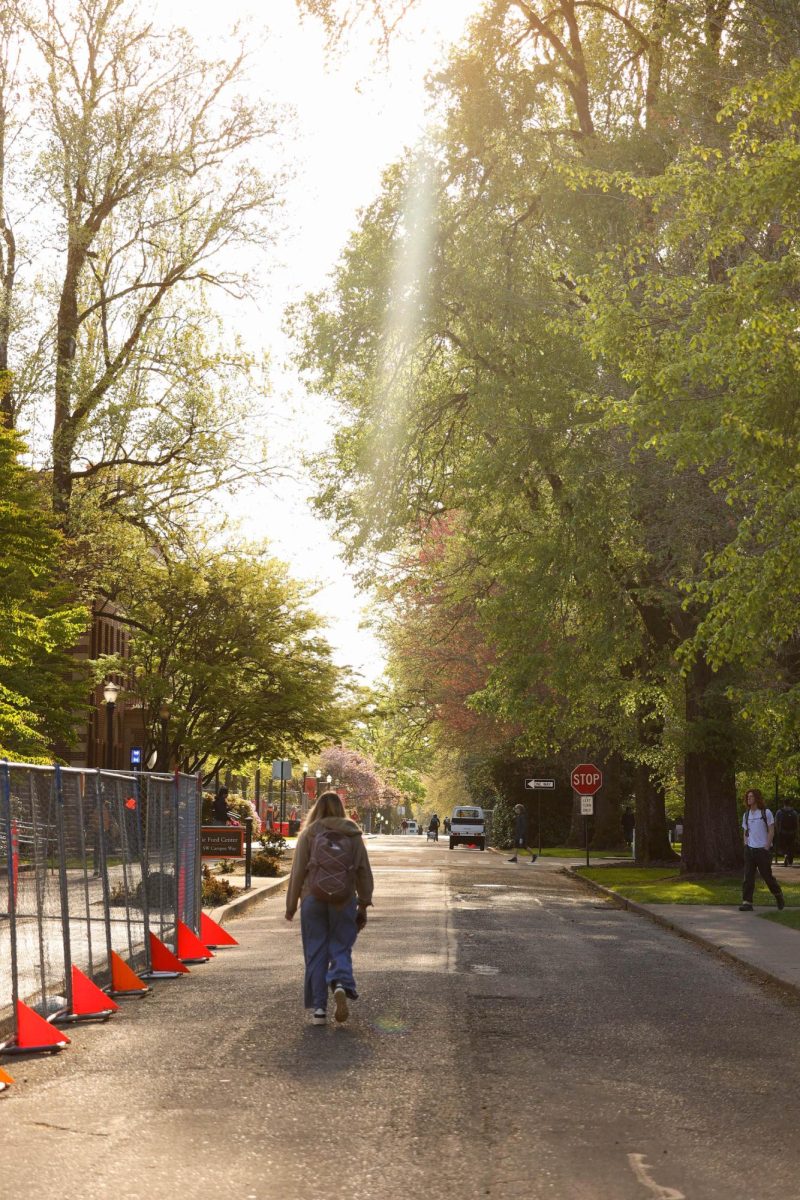

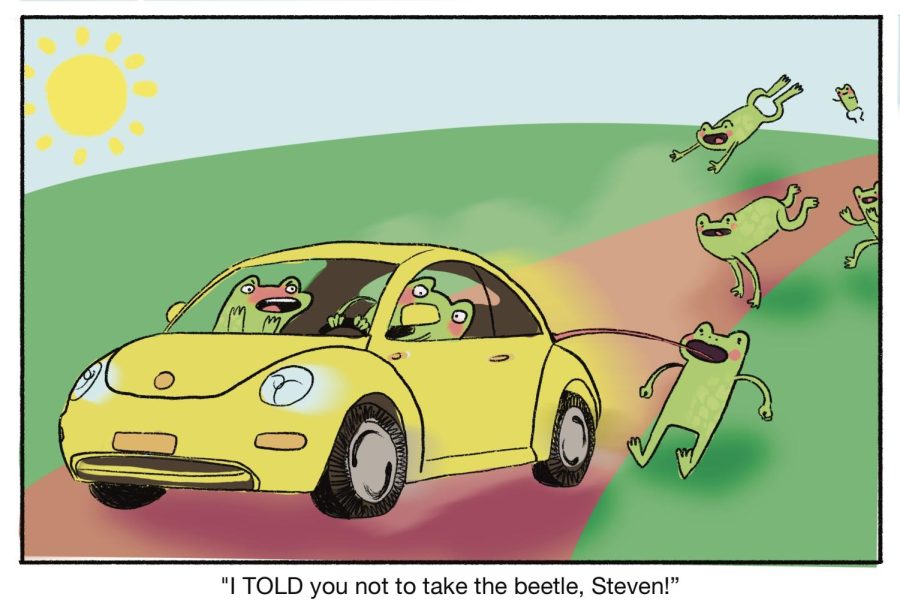

A photo illustration of a Oregon State University college degree burning on March 1. Questions are raised of whether a four year college degree is worth the debt that comes along with it in the face of an experience driven employment environment.

March 6, 2023

Editor’s Note: This column does not represent the opinion of The Daily Barometer. This column reflects the personal opinions of the writer.

A tightening labor market threatens the legitimacy of college degrees, as companies like Google are reducing their educational requirements to refocus their priorities on skills and experience.

The Washington Post reported that companies cutting their college degree requirements has led to a surge in hiring.

Fortunately, college degrees still do — and will continue to — remain a valuable source for building wealth.

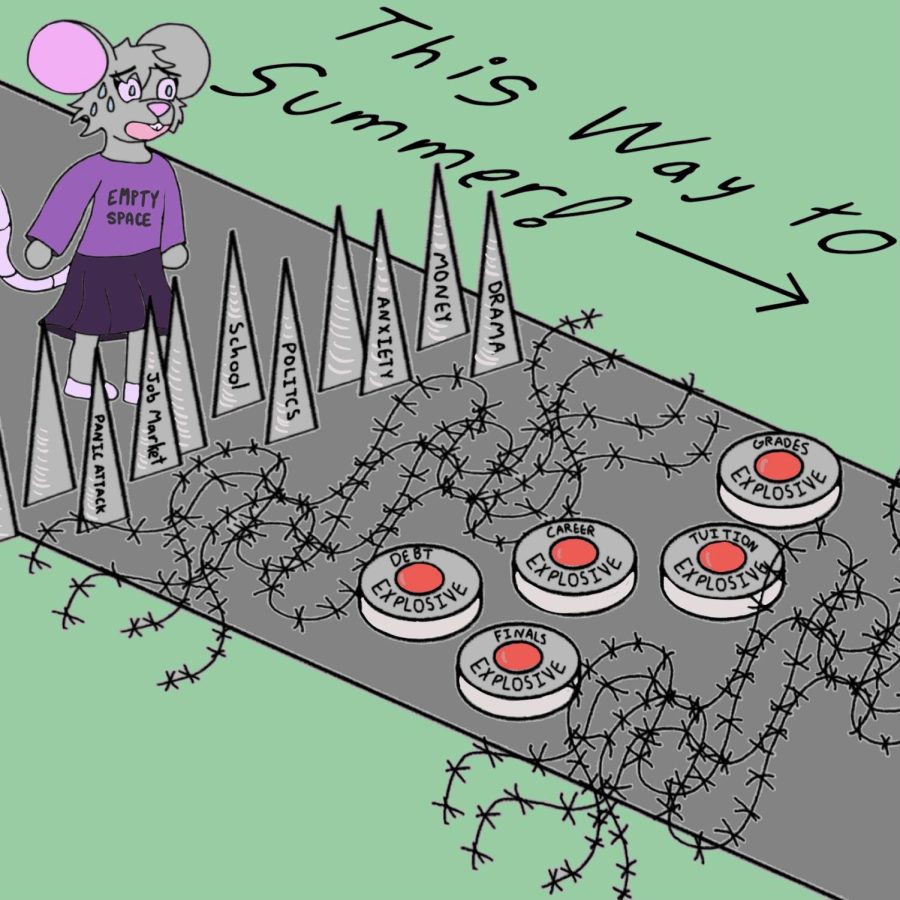

With student loan debt almost at $2 trillion nationwide, some students leave college and enter the job market already down six-figures. Every so often the question of whether a four-year degree is a scam or not makes the rounds in social discourse among teenagers and twenty-somethings.

While college may not outright be a scam, the modern day price of a degree hasn’t yet caught up with the quality of the education. Depending on the career one wants to pursue, there might be better alternatives.

It’s important to consider all possibilities when making important decisions, like attending a four-year university.

Brandon Hamilton, a third-year marketing major, wouldn’t consider college a scam, although there are levels to the necessity of a college degree.

“I think it’s a good tool, if what you’re going to do requires that, like if you’re going to be an engineer,” Hamilton said.

Hamilton felt that college would be a better experience if the students weren’t forced to spend money on pre-requisite classes. He said universities should focus strictly on the skill specialization necessary for their career field.

“I think the teaching of it could be more real world applicable,” Hamilton said. “In the business class I’m taking now, Introduction to Entrepreneurship, I feel like that class should be helping entrepreneurs with entrepreneurship endeavors, and not just teaching (us) how to work in a group.”

Hamilton works as the Vice President of the Lonnie B. Harris Black Cultural Center, has previously been involved in the marketing club, and also spent time in the sports product development club. He said that OSU has provided him with the opportunities to build connections.

He plans to become a freelance photographer and videographer, and eventually start his own business.

Carson Mandera, a fourth-year kinesiology major, agreed that there is still some necessity for college, but for careers that require a degree.

“There are many better, cheaper options for education, like google career certificates, on the job training, or even just self study,” Mandera said. “There’s an endless amount of information on the internet that can be accessed for free.”

Mandera shared the same sentiment as Hamilton, feeling as though colleges force students to spend too much time taking classes they don’t need.

According to him, internships and apprenticeships are an effective means to receive an education.

“I think self-study should be taught, and classes should be a lot more hands-on (with) practical learning,” Mandera said.

As someone whose passion is fitness and helping others, Mandera is thinking about taking his education further, studying to become a physical therapist. Schooling would then be necessary for his goals.

In the Washington Post article mentioned earlier, Lucy Mathis dropped out of her computer science undergraduate program to pursue an internship in information technology at Google. She now works for the company making six figures as a systems specialist.

According to the article, although she wasn’t good at academics, she had a knack for information technology.

The first college in the US is claimed to be Harvard University, which was founded in 1636 (chartered in 1650), one of the most prestigious universities in the world.

Before college was widely accessible, building wealth through laboring, apprenticeships and self education was very common. John D. Rockefeller and Andrew Carnegie, two of the richest men in modern history, were just two people who never went to college but amassed great wealth.

One can feel justified in believing a college degree isn’t necessary to be successful and build wealth, and they wouldn’t be wrong in feeling that way.

The only thing worse than wasting money studying for a degree with little job growth and a low average median income is dropping out with no tangible goals, or because someone else did it and happened to get rich.

Yes, Bill Gates dropped out and, yes, Mark Zuckerberg dropped out, but that’s not telling the full story.

They both left Harvard because the university was interfering with their billion dollar ideas. Even if their plans failed, they would have had a very comfortable safety net to fall on.

Mary Maxwell Gates, mother of Bill Gates, was the first woman to chair the national United Way’s executive committee and the first woman on the First Interstate Bank of Washington’s board of directors. Zuckerberg’s father and mother were both a dentist and a psychiatrist, respectively.

For a first generation or low-income student, dropping out and spending your life savings to start a business in the garage is not feasible.

For the average person, data and statistics can be relied on to help us direct our decisions. According to Georgetown University’s research on the payoff of a bachelor’s degree, a bachelor’s is worth 2.8 million on average over a lifetime, and bachelor’s degree holders earn 31% more than those with an associate’s degree and 84 percent more than those with just a high school diploma.

The average repayment period for student loans ranges anywhere from 10 to 30 years, depending on how deep in debt the repayer is.

Colleges need to be thought of as an investment, because the one that you plan on attending will treat it like one, even if you don’t.