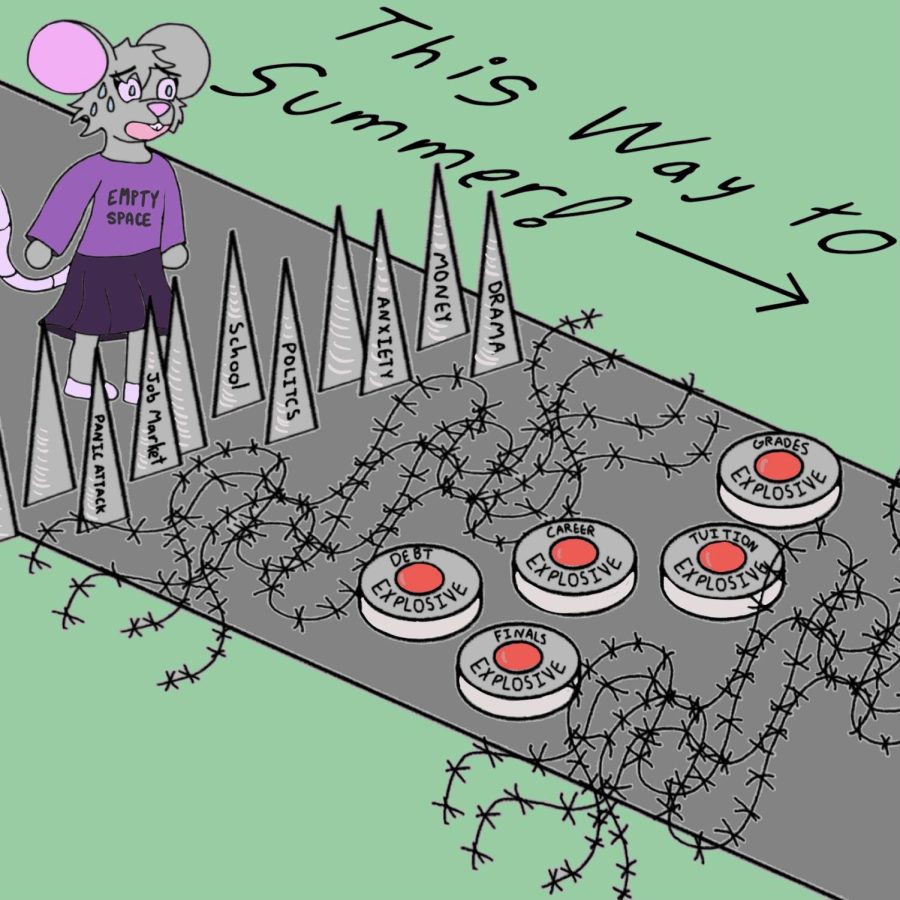

According to the U.S. Department of Education, the Biden-Harris Administration is working on fixing the broken student loan system with a plan that will be implemented August 14.

According to the Saving on a Valuable Education Plan, more than 1 million low-income borrowers are able to qualify for $0 loan payments. This will allow them to focus on basic needs such as food and rent, according to the DE.

This plan will essentially replace the Revised Pay As You Earn plan, and borrowers who used the REPAYE plan will get benefits from the SAVE plan, according to Federal Student Aid.

Anyone with direct federal loans is eligible to apply for the SAVE plan, according to Lane Thompson, student loans ombuds at the Division of Financial Regulation in Oregon.

“You just need to go online and apply,” Thompson said.

The SAVE Plan will calculate a monthly payment amount based on your income and family size, according to FSA.

FSA states that if you are a single borrower earning $32,800 or less, or a family of four earning $67,500 or less, no loan payments will be owed. In addition, for borrowers who are earning more than these amounts, $1000 will be saved a year compared to other income-repayment plans.

The plan will be divided into two parts, according to Thompson. Those who are looking to make payments in November will have an increase in protected income.

“What that means is that it’s going to be a smaller percentage of income that people have to pick,” said Thompson.

The second part is going to happen in July 2024. What will change will be the addition of new benefits, including taking a smaller percentage of income and forgiving balances after 10 years.

“It used to be that you had to pay some percentage, over $18,000 a year, and now it’s a percentage of your income over $32,000 a year. So basically, they have just increased how much of your take home pay you get to keep on this plan,” said Thompson.

According to Keith Raab, director of financial aid at Oregon State University, the SAVE plan differs from other income-driven repayment plans in several ways. The plan will provide the lowest monthly payments, 100% of remaining interest after scheduled payments will be eliminated, and spousal income will be excluded.

“The income exemption threshold is higher, allowing more borrowers to qualify for $0 monthly payments,” Raab said.

According to the DE, “Current IDR plans require all borrowers, even those who only attended school for a single term, to repay their loans for at least 20 or 25 years before receiving forgiveness of any outstanding balance.”

Out of all states, Oregon ranks 27th for having the largest number of residents with student loan debt. In addition, 543,000 Oregon residents have had some amount of student loan debt, with each indebted resident owing an average of $37,017, according to Words Rated.

In addition, 36.6% of undergraduates, 25.5% of students at 2-year colleges, and 45.90% of students at 4-year colleges in Oregon take out student loans each year, according to Wordsrated. On average, about $6,685 is awarded to 4-year college students each year, which for many low-income earners, is not enough.

“The SAVE Plan increases the income exemption threshold from 150% to 225% of the poverty line,” said Raab. “This means that borrowers with incomes below 225% of the poverty line will not owe any loan payments.”