Opinion: Department of Revenue accused of religious discrimination

May 1, 2018

Oregon set the field for religious freedom laws, Montana religious laws.

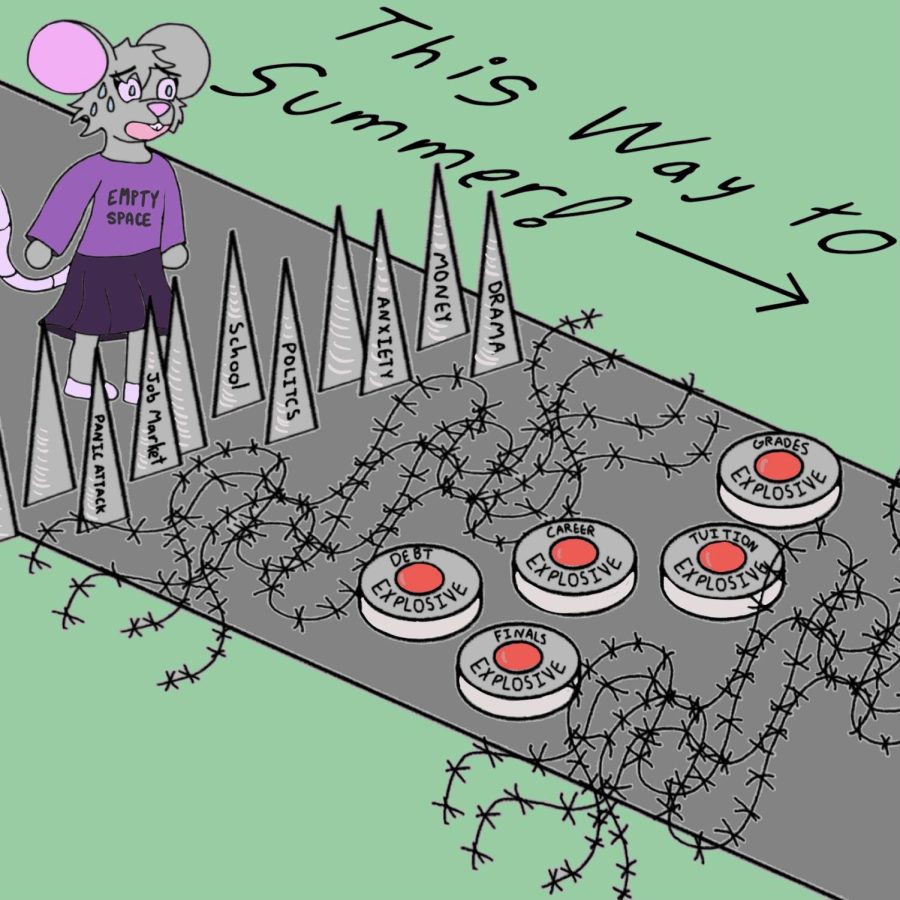

Our country was founded on the discouragement of government entanglement with theological sects and the promotion of religious freedom. On this precedent, we’ve run into many issues regarding the church and the state.

The Montana Supreme Court is reviewing a case where the Department of Revenue has motioned to exclude religious schools from receiving a tax credit scholarship.

“[There] shall not [be] any direct or indirect appropriation or payment from any public fund or monies for any sectarian purpose. Or to aid any church or place of education controlled in whole, or in part by any church or religious sect,” Article X section 6 states in the Montana Constitution.

The DOR in Montana makes their case that scholarship money going to students who desire to apply themselves to a religiously affiliated school directly violates this article, for they’re indirectly contributing to the church.

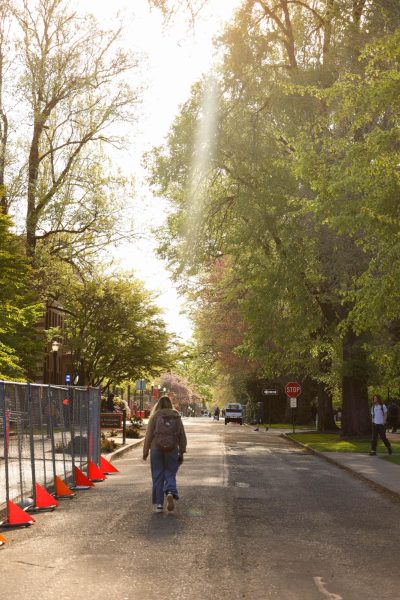

Connor York is an alumni of Oregon State University with a degree in political science and works as the assistant director of the Newman Center on Monroe street. This Catholic campus ministry receives most financial support from donors and different levels from the Catholic Church, while students receive scholarships on an individual basis.

“Private universities and institutions play an important role in education and they should have the same opportunities other schools do,” York said in a phone interview.

York said that just because people may have different opinions about religious groups, it doesn’t mean they should be rejected their religious rights. Non-secular groups should demand the same support as secular groups.

The Montana scholarship is funded by businesses who receive a $150 tax break. The money is dispersed to families around the state to reduce tuition prices of private schools. According to Private School Review, there are 120 private schools in the state and 66 percent are religious or have a religious affiliation. This program was established to provide more choices to students seeking alternative education.

“The average private school tuition is $8,518 for elementary schools and $6,355 for high schools,” Private School Review said.

Rejecting religious schools from the disbursement limits the choices student have for their education and places the full weight of tuition on the families.

“Congress shall make no law respecting an establishment of religion, or prohibiting the free exercise thereof,” said the 1st Amendment.

So how do we draw the line between the institutions of religion and government?

The state of Oregon was the first state to implement the Religious Freedom Restoration Act and has a similar idea about government monies and religious institutions, but isn’t nearly as direct as Montana.

“No money shall be drawn from the Treasury for the benefit of any religious institution, nor shall any money be appropriated for the payment of any religious services,” according to the Oregon Constitution.

This statement focuses on direct allocation of monies, and isn’t quite specific about ruling in cases of education.

Rorie Solberg, political science professor, has been at Oregon State University since 2002. With a research focus in Judicial Politics, Solberg teaches a series on constitutional law and classes such as Intro to U.S Government and Politics.

“I don’t think it’s a movement against religious schools. A plain reading would suggest the Montana Constitution has a much stronger version of the Establishment Clause, and when you look at that, this is an indirect aid to religious institutions,” Solberg said.

The Department of Revenue, however, firmly states that indirectly contributing monies to a religious sect undermines their state constitution.

“Both sides come at this case with strongly held beliefs, and there’s good and strong arguments made on both parties. These aren’t easy cases,” Solberg said.

The DOR has a fair case stating this tax credit scholarship is against their constitution, but this decision also discourages and limits religious participation for the students affected.

As citizens we need to ask ourselves what rights matter, why they are important and acknowledge how we can include everyone.