Tuition increase approved by Board of Trustees

April 7, 2018

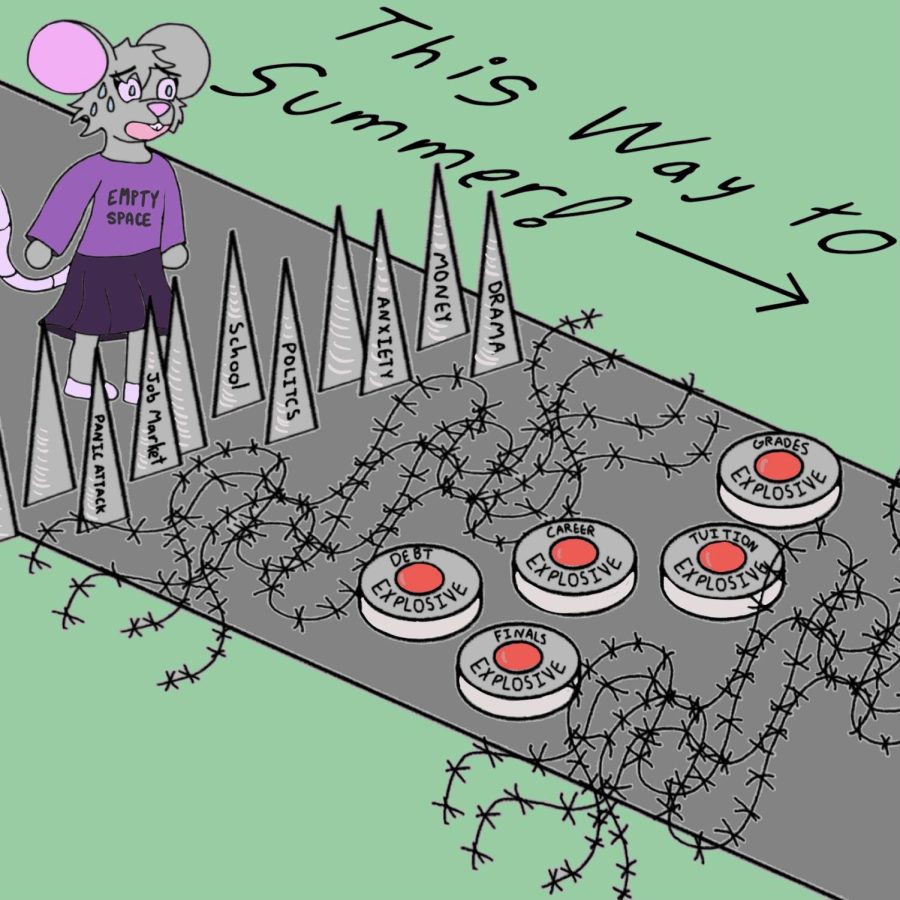

The OSU Board of Trustees approved a tuition increase which resulted in a resident undergrad increase of 3.47 percent, non-resident undergrad 2.27 percent. Along with the tuition increase, financial aid will increase by $2.3 million, $315 annual increase residents, and $630 annual increase non-residents.

As the discussion went on, three scenarios were presented to the committee of how income will be handled in the following year. Mike Thorne said it would be a mistake to start spending our money now.

“We got to go back and reduce just to meet the obligations we have on other big issues. In having a balanced budget we’ll either raise money or cut costs to get there, in which I support scenario B,” Thorne said.

Patty Bedient, supporting scenario B, said the compounding of small numbers in raising resident tuition will make a difference overtime.

“We’re actually much closer to benchmark on the non-resident then we are to the resident. And those non-residents do form our ability to operate the institution, in raising out of state tuition could put people in jeopardy for enrollment. Obviously people who are out of state have other places to go, so I’m sensitive in not raising that in above where we are,” Bedient said.

President Ed Ray started the meeting off by explaining the main goals for success among Universities.

Ray said that there is a strong focus in the country for people to pursue college degrees. He said that it is becoming even more pressing for those coming from disadvantaged situations such as low-income and first-generation college students.

“We really are trying to create a national higher education dialogue around changing the trajectory with respect to student success through graduation,” Ray said. “Every student matters, not just our students at OSU, every student needs in America to be given a better deal in terms of opportunities.”

Regarding costs, Mark Baldwin said society and political climates are changing, and it’s difficult to completely predict the future.

“According to our future analysis, while we may be a little more than 5 percent cheaper, the actual out of pocket may be higher. If someone sort of in the middle of the income distribution is taking on significantly more debt, well then our valued proposition is much less enticing for those people,” Baldwin said.